Stocks, IRAs, Donor Advised Funds, and Cryptocurrency

Make a Difference by Donating Non-cash Assets

The Pediatric Brain Tumor Foundation is ready to help you create a philanthropic strategy tailored to meet your family’s charitable, financial, and tax-planning objectives.

Non-cash gifts are often the most tax-smart charitable donations, and the Pediatric Brain Tumor Foundation has made it easier than ever to donate gifts of stock, give through a Qualified Charitable Distribution (QCD) from your IRA, make a gift through Donor Advised Funds, or donate cryptocurrency. Watch this brief video from our partner, FreeWill, to learn more about which giving method is most beneficial for you.

Start making a difference with the online tools below or contact us at [email protected] to speak with a member of our philanthropy team.

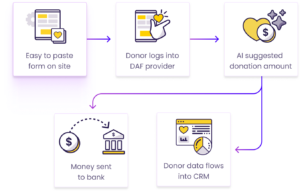

Donate through your Donor Advised Fund

A donor-advised fund (DAF) is a centralized charitable account that makes it easy for individuals, families, and businesses to make tax-deductible charitable donations of cash, publicly-traded stock, and, in some cases, certain illiquid assets. Our no-fee online tool makes it easy to connect directly to 1,000+ supported Donor-Advised Fund providers and submit your grant request to the Pediatric Brain Tumor Foundation in only a few clicks.

A donor-advised fund (DAF) is a centralized charitable account that makes it easy for individuals, families, and businesses to make tax-deductible charitable donations of cash, publicly-traded stock, and, in some cases, certain illiquid assets. Our no-fee online tool makes it easy to connect directly to 1,000+ supported Donor-Advised Fund providers and submit your grant request to the Pediatric Brain Tumor Foundation in only a few clicks.

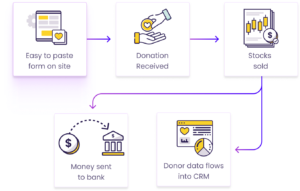

Gifts of Stocks and Securities

Donating stocks allows you to avoid the capital gains tax, and if you itemize deductions, you can also take a charitable deduction for the entire donation amount. We’ve partnered with FreeWill to provide this secure online tool that enables you to donate your appreciated assets in 10 minutes.

Donating stocks allows you to avoid the capital gains tax, and if you itemize deductions, you can also take a charitable deduction for the entire donation amount. We’ve partnered with FreeWill to provide this secure online tool that enables you to donate your appreciated assets in 10 minutes.

Give from your IRA

Qualified Charitable Distributions (QCDs), also known as IRA Charitable Rollovers, are the savviest way for individuals age 70½ or older to use their IRAs to maximize their charitable impact. Use this online tool to learn more about QCDs, fill out forms from your IRA custodian, or request a tax acknowledgment letter for a gift already made.

Gifts of Cryptocurrency

Crypto charitable donations are tax-deductible to the fullest extent permitted by law if you pay taxes in the U.S., and cryptocurrency donors may also be eligible to significantly reduce what they would otherwise owe in capital gains taxes. The Pediatric Brain Tumor Foundation accepts donations in Bitcoin, Ethereum, and over 80 additional leading cryptocurrencies. Learn how your gift of crypto to the Pediatric Brain Tumor Foundation can be processed quickly and safely with Crypto for Charity, The Giving Block and Gemini Trust Exchange.

significantly reduce what they would otherwise owe in capital gains taxes. The Pediatric Brain Tumor Foundation accepts donations in Bitcoin, Ethereum, and over 80 additional leading cryptocurrencies. Learn how your gift of crypto to the Pediatric Brain Tumor Foundation can be processed quickly and safely with Crypto for Charity, The Giving Block and Gemini Trust Exchange.

Planned Giving

Your compassion has the power to extend far beyond your lifetime. When you choose to leave a gift in your will to the Pediatric Brain Tumor Foundation, you become a beacon of hope for countless families facing the daunting challenges of childhood brain cancer. Learn how we’ve partnered with the online estate planning tool FreeWill to help you protect the future of the people and causes you love – at no cost to you.

The Pediatric Brain Tumor Foundation is a 501(c)(3) tax-exempt charitable organization (EIN/Tax Identification Number: 58-1966822). All tax-related questions about donations should be directed to a qualified, professional tax advisor.

Whatever form your gift takes, you can be confident your generosity will help us lead the way toward a future without childhood brain cancer. Explore the many ways you can make a difference in families' lives.

Your Impact

- $50M in research funded by the Pediatric Brain Tumor Foundation community

- $5.8M in financial relief provided to families in crisis following a child's brain tumor diagnosis

The Pediatric Brain Tumor Foundation was key in supporting me in the beginning of my career. The research results generated by their Early Career grant allowed me to get more funding, and the training and mentorship were essential in helping me set up my own independent lab dedicated to pediatric brain tumors.Dr. Pratiti (Mimi) Bandopadhayay, Dana-Farber Cancer Institute